What Happens When Your Car Is Totaled

Getting into a car wreck can have all sorts of terrible consequences, and one of the many challenges is having your vehicle get totaled. If you drive an older car, even if you think the accident you were in was minor, you may be surprised to learn that your insurance company declares it to be totaled.

Many Oklahomans depend on their cars for work, school, childcare, getting groceries, and every other thing we need to do to live a normal life. That’s why it’s important to know what your options are if you’re unable to drive your car. Keep reading to learn what you can do about a total-loss vehicle and how Oklahoma total-loss laws apply to you.

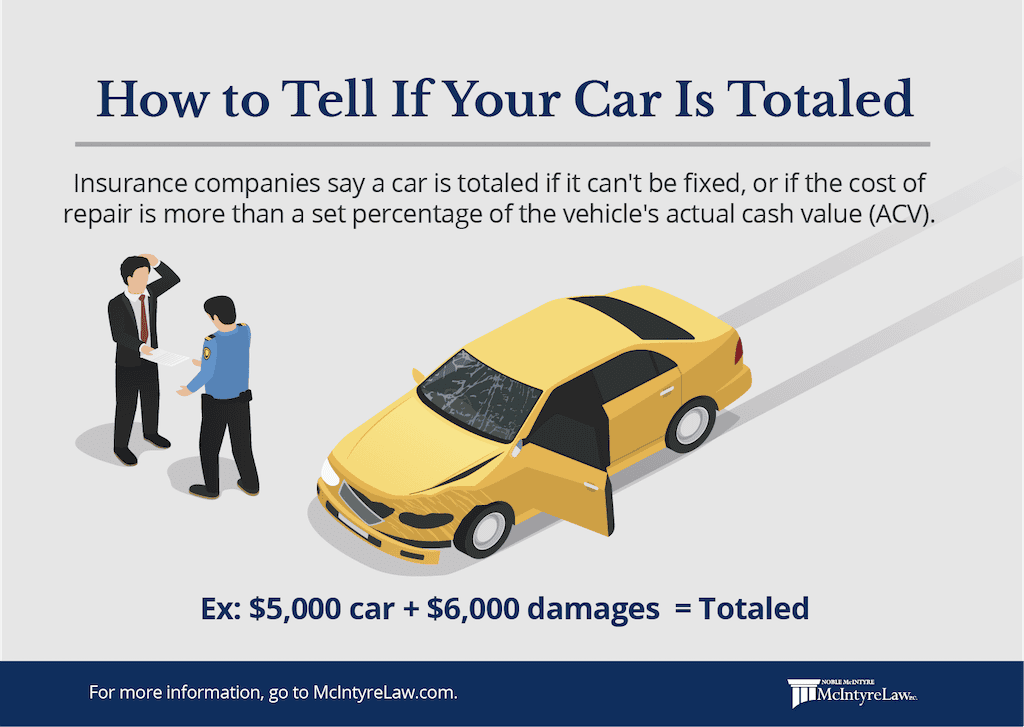

What does “total loss of a vehicle” mean?

An insurance company will declare a vehicle totaled if the damage is so bad that it can’t be repaired or if the cost of repairing it is more than a set percentage of the totaled car’s value. Most insurance policies are set up to pay the lesser of two amounts:

- The cost to repair the vehicle to the way it was before the crash, or

- The cash value of your vehicle.

Insurance adjusters determine the value — known as the actual cash value (ACV) — by figuring the market value of the vehicle in the condition it was in just before the accident. And your collision deductible will be subtracted from the ACV.

In Oklahoma, the total-loss threshold is 60% of ACV. In other words, if the insurance company determines that your car needs repairs that are more than 60% of the actual cash value, the state allows the insurer to total it. So, if the ACV of your car is $5,000, but you need $3,500 in repairs, it’s a total-loss vehicle.

Can an insurance company force you to total your car?

If you disagree with your insurance after a total loss is declared, you can often dispute it. However, if the cost of repairs still ends up being over Oklahoma’s total-loss threshold of 60% of ACV, the vehicle is a “total loss.”

You still have options, though. You can keep your car if it’s totaled and change its title to a salvage title. The insurance company may then subtract the car’s salvage value from the ACV and pay you the difference. Salvaged vehicles still need to be repaired, though, before plates can be issued. And you may have trouble getting it insured again.

Can you still drive your car if it was totaled?

If your car is declared a total loss, you can still drive it, technically, if you get a salvage title for it, get the damage fixed, and get it reinsured. That may be easier said than done, though. And it’s only the case if the car can be repaired at all.

Dealing with the total loss of a vehicle can be a terrible burden, making it difficult for an individual or a family to get to work, attend school, go grocery shopping, or do any of the things we all need to do to live our lives. Added to that stress is the struggle to now fix or replace the totaled car, which can be especially difficult for car owners who still owe money on the total-loss vehicle.

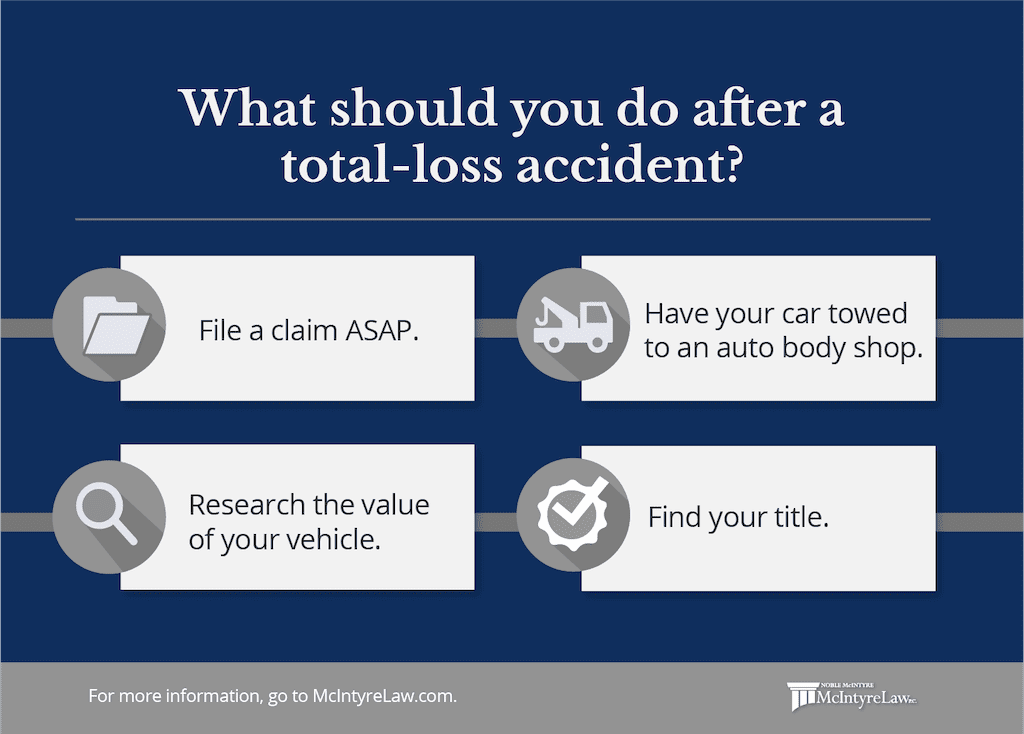

What should you do after a total-loss accident?

After a car accident, it’s common to be in literal shock. These events are traumatic, and it can be difficult to gather your thoughts and pull it together enough to deal with insurance companies. But since you’ll have to anyway, one way to make it just a little easier is to have an idea of what happens when your car is totaled and the order of what to do next. Your next steps include the following:

- Don’t wait to file a claim. The process from alerting your insurance carrier that you’ve been in an accident all the way to a final resolution can take a long time. Delaying only makes it worse. But you also don’t want to jump on the first offer after a total loss. The car insurance settlement will be as low as they can make it, and you may need to fight to get what you actually need. With that in mind, to the best of your ability, try to collect evidence after the accident to support your claim.

- Have your car towed to the preferred auto body shop. You may need to get your car towed after your accident. If you’re close enough to a place you know and trust, have it towed there to save time.

- Research the value of your vehicle. The only way to know after a total loss that your car insurance settlement is fair is to look up that value yourself. Get several estimates from as many trusted sources as possible, such as Kelley Blue Book or Edmunds. You could also check to see how much similar cars go for at local dealerships. Don’t forget to note any improvements you’ve made that could affect your totaled car’s value. If you still owe money on the car, find out the exact amount you have outstanding. There may very well be a balance left over, especially if you took out the loan recently, as the ACV is often lower than what you owe because of depreciation. Unless you have gap coverage to make up the difference, you will be expected to pay it out of pocket.

- Find your title. If your vehicle is a total loss, you’ll have to sign it over to the insurance company. If you decide to keep it, you’ll then need to get a salvage title.

Your car was totaled and you’re not at fault. Who’s going to pay for the damages?

Oklahoma, like many states, has at-fault auto insurance liability laws. That means if your car is totaled and you’re not at fault, the insurer of the motorist who caused the accident must pay for your personal and property damages as well as for their own client’s.

However, it may not be so clear-cut who’s at fault, and you may need to prove to the insurance company that the other driver was responsible. That may take a long time — time you don’t have if you need immediate medical treatment or have to secure transportation after your car was totaled.

So, even if you’re not at fault, you may have to pay your deductible, at least in the near term, to get the ball rolling with your own insurance. Your insurer can then seek reimbursement (including for your deductible) from the other party’s insurer.

Remember: Insurance companies increase their profits by paying out as little as possible. The actual cash value they come up with may be much lower than is acceptable, or insurance may deny your claim entirely. You can’t be expected to know how to fight an insurance company over a totaled car — that’s why it’s in your best interest to contact experienced car accident attorneys as soon as possible.

What if the at-fault driver doesn’t have car insurance?

Uninsured and underinsured motorists can cause problems for drivers who obey Oklahoma law and carry proper auto insurance. About 1 out of every 4 motorists in Oklahoma is uninsured. That’s why it’s a good idea to get uninsured motorist/underinsured motorist (UM/UIM) coverage.

If the at-fault driver doesn’t have coverage, or if it was a hit-and-run, your insurance will have to cover your expenses, but you’ll have to pay the deductibles unless you have a UM/UIM policy. You also have the option of filing a personal injury lawsuit against the at-fault driver to get compensation that way.

Total-loss laws in Oklahoma

Oklahoma is an at-fault state, so the insurance company of the driver who caused the wreck (assuming they’re insured according to state law) is supposed to pay for losses of the other drivers involved in the accident. Fault must be demonstrated to the insurer, though, and they may deny your claim of their customer’s fault, or they may say you share in enough of the fault to lower your total-loss car insurance settlement.

According to Oklahoma law, a totaled car is one that needs structural repairs costing over 60% of the vehicle’s actual cash value. When that’s the case, the car must get a salvage title. If the damage percentage is 80% or more, it needs a junk title.

Will your car be replaced with a new one?

How do you get a new car after a total loss? The hard truth is it often isn’t easy. Some insurance policies will cover the replacement cost of a car rather than simply paying out the ACV. This coverage allows you to pay the market price for a new replacement car in the same class as the total-loss vehicle. Many drivers don’t have this option, though, because the premiums on these kinds of policies can be significantly higher than standard auto insurance.

And it’s clear why when you get a typical total-loss car insurance settlement based on ACV. Let’s say your car is totaled in Oklahoma because it needs $6,000 in work but the ACV is only $5,000. But your deductible is $1,000, so that is subtracted, and now you’re down to $4,000. Maybe you still have $3,500 left on the car note, and they’ll take it out of your settlement. Now you’ve got $500 to get a new car. Unless you pay out of pocket for a decent replacement, which many Oklahomans can’t, you’re stuck.

How does a total loss affect your credit?

Automobile accidents don’t register in a credit score. Not directly, at least. What may happen, though, is that the mountain of bills that piles up afterward can wreck your credit if they don’t get paid.

Delinquent medical and auto repair bills, loans that need to be paid, additional loans that need to be taken out — all can be devastating. And at a time when you may not be able to work because of injuries and/or lack of transportation, meaning the financial damage could be lasting.

Get help from an experienced car accident attorney in Oklahoma

At McIntyre Law, our experienced car accident attorneys know how to fight an insurance company after a totaled-car accident. We take into account what you need right now as well as what you’ll need to live in the future, especially if you can no longer work or need long-term care. But it’s important not to delay. We can help you get back on your feet and move forward with your life.