Getting Your Car Fixed After an Accident

Getting into a car wreck can turn your life upside down. One minute you’re driving along with one set of concerns on your mind, and in an instant, you have a whole new set of problems to take their place. Near the top of the list is how to get your car fixed after an accident.

Millions of Americans depend on their cars and trucks to get them to work, school, the supermarket, childcare, and any number of other places that we take for granted — until we don’t have a ride. If you’ve been in an automobile wreck and need to get back on the road ASAP, read on to learn more about where to take your damaged vehicle, who pays for it, how insurance factors in, and what your car accident repair rights are.

4 steps for getting insurance to fix your car after an accident

So, you’ve exchanged insurance information with the other driver(s) at the accident scene, collected evidence and eyewitness information, and talked to the police. The officer at the scene deems that your car doesn’t need to be towed and can be driven away. At this point, how to get your car fixed after an accident means doing the following:

- Call your auto insurance provider. Whether you’re at fault or another driver is, it’s best to alert them to what’s going on and get the appropriate paperwork started. The longer you delay, the longer it takes to get your car back.

- Get estimates on the damage to your car. Your car insurance may want to do an inspection after your accident right away, and/or they may want you to take your car to a specific auto body shop. If you take it to a shop, just get an estimate; don’t start work yet.

- Compare auto repair estimates. Once you have the quotes from the mechanic and the insurance adjuster, see whether the insurance estimate is lower than the body shop estimate, and by how much. You may need to have your insurance company call your auto mechanic and see if they can work it out. At this point, you may want to hire a car accident attorney.

- Have the mechanic contact the insurance company if they find additional damage. No matter how good an insurance adjuster is at their job, it can be hard to identify all the damage done to a vehicle after a wreck. If the auto body shop finds something that needs repairing as a result of the specific traffic accident, make sure they contact the adjuster or the insurer to try to get them to add it to the auto insurance settlement.

You may wonder if you can fix your own car with the insurance money you receive from the settlement. If you still owe money on the vehicle, your creditor isn’t likely to go for that. They’ll want to protect their investment and have the work done by a certified professional.

If you own the car outright, depending on what your insurance policy says, you may be able pocket the settlement and decide what to do from there. Still, that can be very risky if you want to keep driving that car. You may not be able to get the car insured again if the repairs aren’t made by an approved auto body professional. And if you underestimate how much money you need to make the repairs, or you make the damage worse, you will have to pay out of pocket for those additional repairs.

Getting a vehicle repair estimate

How many estimates should you get after a car accident? It would be good to get multiple vehicle repair estimates from different auto body shops, but if your car had to be towed, that may not be realistic. The conversation doesn’t really start until the insurance adjuster gives you their estimate. Note: In Oklahoma, an insurance company can’t force you to travel an unreasonable distance to get an inspection or estimate done.

When you talk to the adjuster about the estimate, make sure you understand what you’re responsible for paying: the deductible. If the deductible is higher than the repair estimate, then you’ll have to pay out of pocket to fix your vehicle.

In Oklahoma, if the estimated repair costs exceed 60% of what the insurance company thinks your car is worth (the actual cash value), then they’ll declare your automobile a “total loss.” If you decide to keep the totaled vehicle and try to fix it, you’ll have to get a salvage title from the state. If the repairs cost 80% or more of the car’s value, you’ll need a junk title.

It’s worth noting that insurance companies make their money by paying out as little money as possible. It’s common for the insurance estimate to be lower than the body shop figure. You can try to have your mechanic advocate for you, but it’s better to consult a lawyer at this point. An experienced attorney will know your car accident repair rights and be more effective at fighting for them.

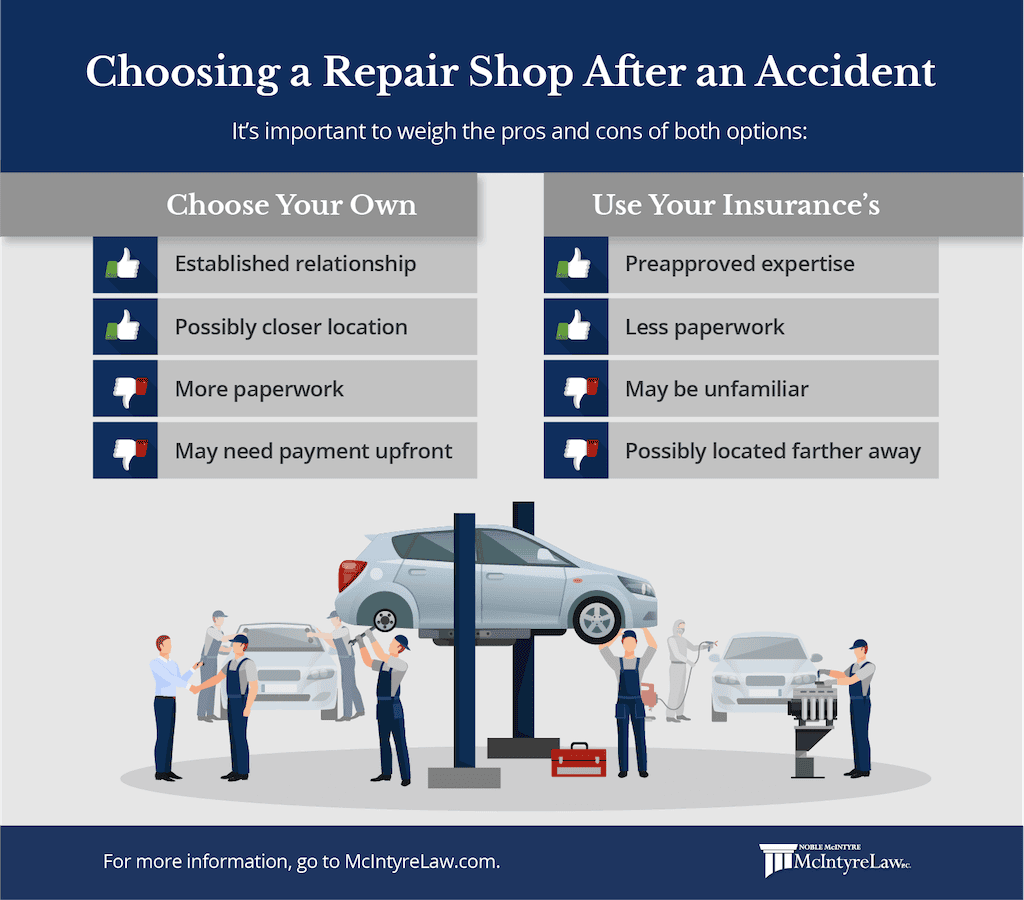

Do you have to use the body shop the insurance company recommends?

In Oklahoma, you don’t have to use the body shop the insurance company recommends. But if you insist on a mechanic that your insurer doesn’t recommend, it may create more red tape for you to wade through, and slow down the process.

No matter what, you should be comfortable with the shop that does your repair work. For many people, that means going with a certified professional. And if that’s your choice, you’ll have less pushback from your insurance company.

Can an insurance company make you use used parts?

Whether you can insist on original equipment manufacturer (OEM) parts comes down to the fine print in your insurance policy. You may also have that right under a plan offered by the vehicle manufacturer. If original parts are important to you, that’s something to work out when you buy your auto insurance.

Still, in Oklahoma, you do have the right to know when non-OEM parts are used as part of your collision repair. By law, they need to be listed on your estimate before any work is done on your car.

How long does it take to get a settlement check from a car accident?

It can take days or even weeks to get a settlement check after a car accident in Oklahoma. How long it takes depends on how clear it was which driver was at fault, as well as how your car insurance inspection goes after the accident. There are many factors at play, but one thing is clear: Don’t put off filing a claim. The quicker you get started, the sooner you’ll get your check and get back on the road.

What if the process is taking too long?

Getting your car fixed after an accident can take anywhere from a few days to weeks. It depends on how proactive you are in reporting and filling out forms, how soon you get the car insurance inspection after the accident, and whether you and the insurance company are in agreement about the extent of the damage and the cost of repair.

If your insurer is dragging its heels, you could get the vehicle fixed by paying out of pocket and then demand reimbursement later. But that can be risky as a strategy. If you got several estimates and went with a more expensive choice, the insurer could agree to only pay the value of the lowest estimate. Also, by fixing the car, you will have removed any urgency for the insurance company to settle any quicker. Plus, they won’t be on the hook anymore for paying for things like a rental car.

If you think the insurance company you’re working with isn’t dealing in good faith, your best bet is to consult a good lawyer and explore your rights.

Who pays for the vehicle damage?

In Oklahoma, the insurance company of the driver who’s at fault should pay for the damage to your car and any personal damages, like medical treatment. It’s not always that simple, though.

There may be a dispute about who is at fault or how much damage there was to your car, and the insurance company may deny your claim. Then you’d have to prove who was at fault and/or the full damage and cost of repair to your vehicle.

Or maybe the at-fault driver doesn’t have insurance, or not enough insurance to cover all the damage. Your insurance company may have to cover your auto repair expenses until it gets sorted out. And you may have to pay for some of it out of pocket and try to get reimbursed later.

What if the other driver doesn’t have car insurance?

According to Oklahoma state law, all motorists must carry the proper auto insurance. However, about a quarter of Oklahomans are uninsured drivers, and many are underinsured. That’s why it’s recommended that you add uninsured motorist/underinsured motorist (UM/UIM) coverage as part of your auto insurance. It can protect you in case an uninsured driver hits you.

In cases where the at-fault driver doesn’t have coverage, or if you don’t know who hit you, such as a hit-and-run, your insurance will have to pay for your car repairs, but you’ll have to pay the deductibles unless you have a UM/UIM policy. You could also sue the at-fault driver to get compensation that way.

What if you don’t have car insurance and you were not at fault?

Oklahoma is an “at-fault state,” meaning that the driver who was at fault in the traffic accident is responsible for paying the damages. If they’re insured and their fault can be proven, you should be okay in the long run, but you may have to pay some money out of pocket before you get your settlement check from the other driver’s insurance company. If both you and the at-fault driver are uninsured, the other driver is still on the hook, but if they can’t pay for your damages out of pocket, you may be stuck with the bill anyway.

That said, it’s important to note that Oklahoma law requires every driver to carry a minimum level of auto insurance. Your policy must have:

- $25,000 per person for bodily injury

- $50,000 maximum payout for bodily injury per accident

- $25,000 minimum coverage for property damage

The penalties for driving without insurance include fees, jail time, and a suspended driver’s license and registration.

Diminished value claims: How much value does a vehicle lose after an accident?

How much does a car depreciate after an accident? Anywhere from hundreds to thousands of dollars. Even if the repairs were perfect and the car’s in good shape, the simple fact that your vehicle was in a collision will automatically lower its value in many dealers’ minds.

You might be able to recover some of that lost value after a collision by filing a diminished value claim. In Oklahoma, though, you can only do so if you weren’t at fault in the accident. And if the at-fault driver isn’t insured, uninsured motorist coverage doesn’t apply in the state.

Know your accident repair rights

Even when you know how to get your car fixed after an accident, getting a fair shake from insurance companies isn’t always easy. And traffic and insurance law can be extremely difficult for a layperson to fully understand. If you’ve been in a car, truck, or motorcycle collision in Oklahoma, the attorneys at McIntyre Law can explain your car accident repair rights to you and help you get back on the road.